Alturas Capital Partners Adds Denver Property to Portfolio

Written by Bennett Williamson | December 13, 2021

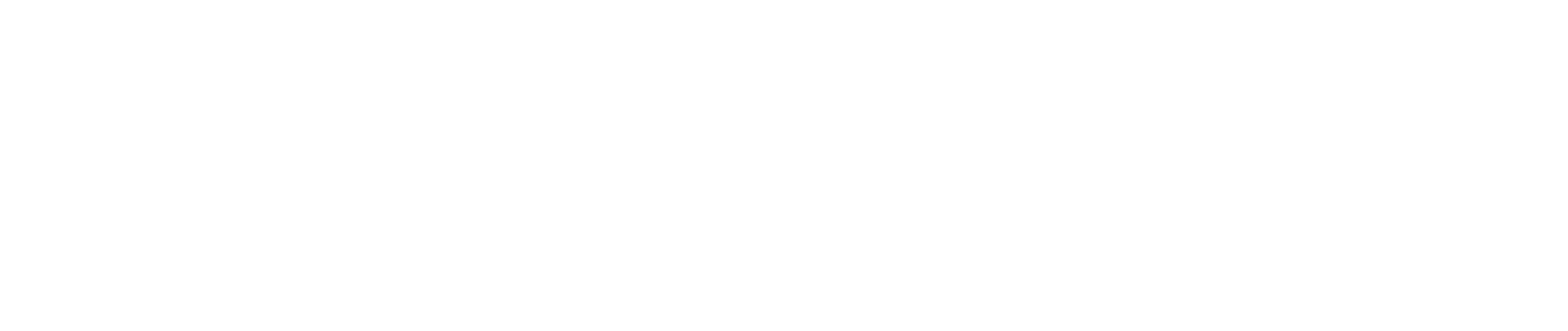

DENVER -- Alturas Capital Partners, based in Boise, Idaho, has added another Colorado asset to its growing portfolio which now exceeds 2.5 million square feet in five western states. Orchard Pointe is a 121,000 square foot office property located in southeast Denver, Colo. in the heart of the Denver Technological Center (DTC).

The six-story office building is 92% leased to 23 diverse tenants including Fairway Independent Mortgage Corporation and Regency Centers Corporation. The property is well-positioned in the DTC at the interchange of Interstate 25 and Orchard Road and is situated on 3.69 acres of land. Orchard Pointe is clearly visible from Interstate 25 and is located near two light rail stops making it easily accessible. The building is part of the southeast office market which is the largest and highest performing office market in the Denver metro area. Orchard Pointe is surrounded by several amenities including parks, restaurants, and hotels, and is in proximity to a group of affluent neighborhoods.

Denver has a robust economy that is steadily growing as its central location makes it easily accessible to much of the United States. The city also has access to many outdoor recreational amenities. Companies are drawn to this area because of these amenities and other “quality of life” advantages as the metro area continues to thrive.

Orchard Pointe is the third Alturas Capital Partners-owned property in Denver. In June of 2021, Alturas acquired 6455 Yosemite and Stanford I, two office properties also located in the DTC. Nearby in Colorado Springs, Alturas Capital Partners now has six properties. As the portfolio continues to grow, the company has added new team members including a team in Colorado Springs and a team in Denver. The company plans to continue to grow in Denver and throughout the state as well as throughout the Intermountain West.

Along with a strong team, this collaboration-focused company relies on partnerships and this deal was no exception. Bellco Credit Union provided the debt financing for the project. Chad Flynn and his team at CBRE represented the seller and were instrumental in facilitating the transaction.

Travis Barney, CEO of Alturas Capital Partners said, “At the center of all that we do is the people who help us make it happen. We initially started working on this project pre-pandemic, and it certainly would not have made it to closing without the persistence and problem-solving collaboration of our team, our lender, the seller, and the leasing and property management teams.”

Alturas Capital Partners is a real estate investment and operating company based in Boise, Idaho. Alturas owns and operates real estate throughout the Western United States, with an emphasis on the Intermountain West and Inland Northwest. The company has been built on long-term partnerships with investors, brokers, and tenants and its mission is to provide value to these partners. The company was established in 2015 and has grown significantly with now approximately $400 million in assets under management. Alturas Capital Partners is currently seeking to acquire additional assets in the Western United States. Contact us for more information.