Who are we?

We are value-generating, enduring, partners.

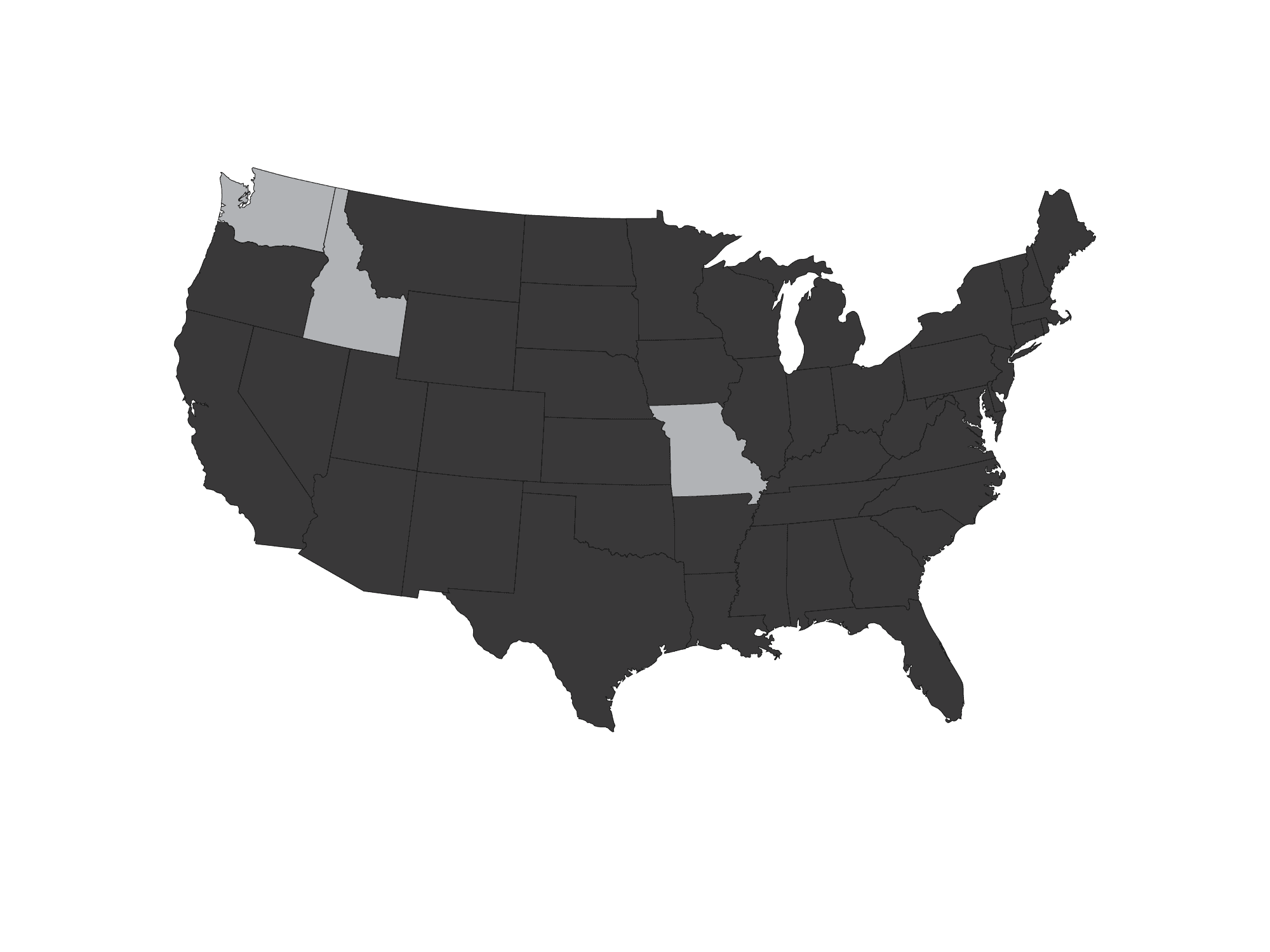

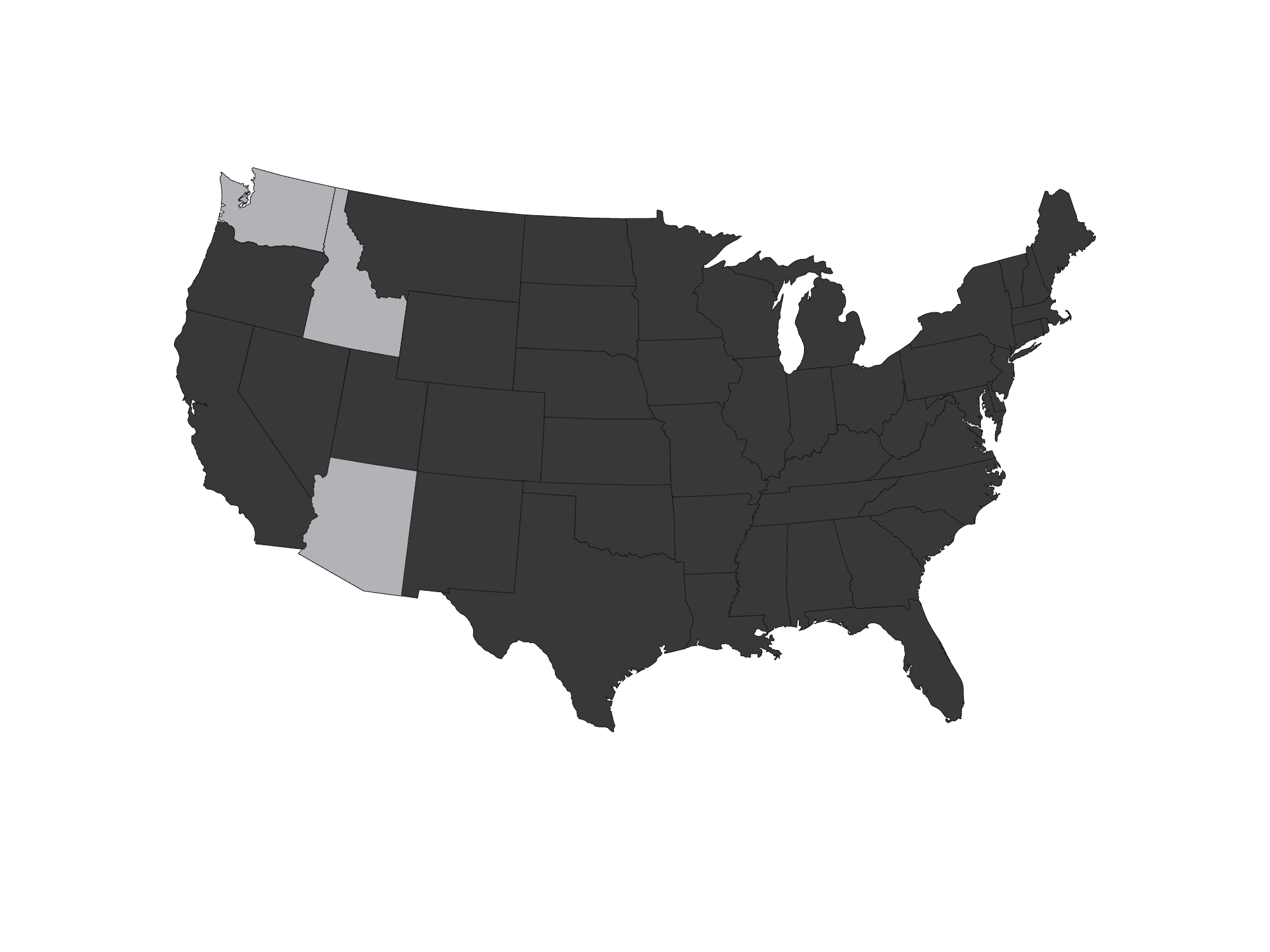

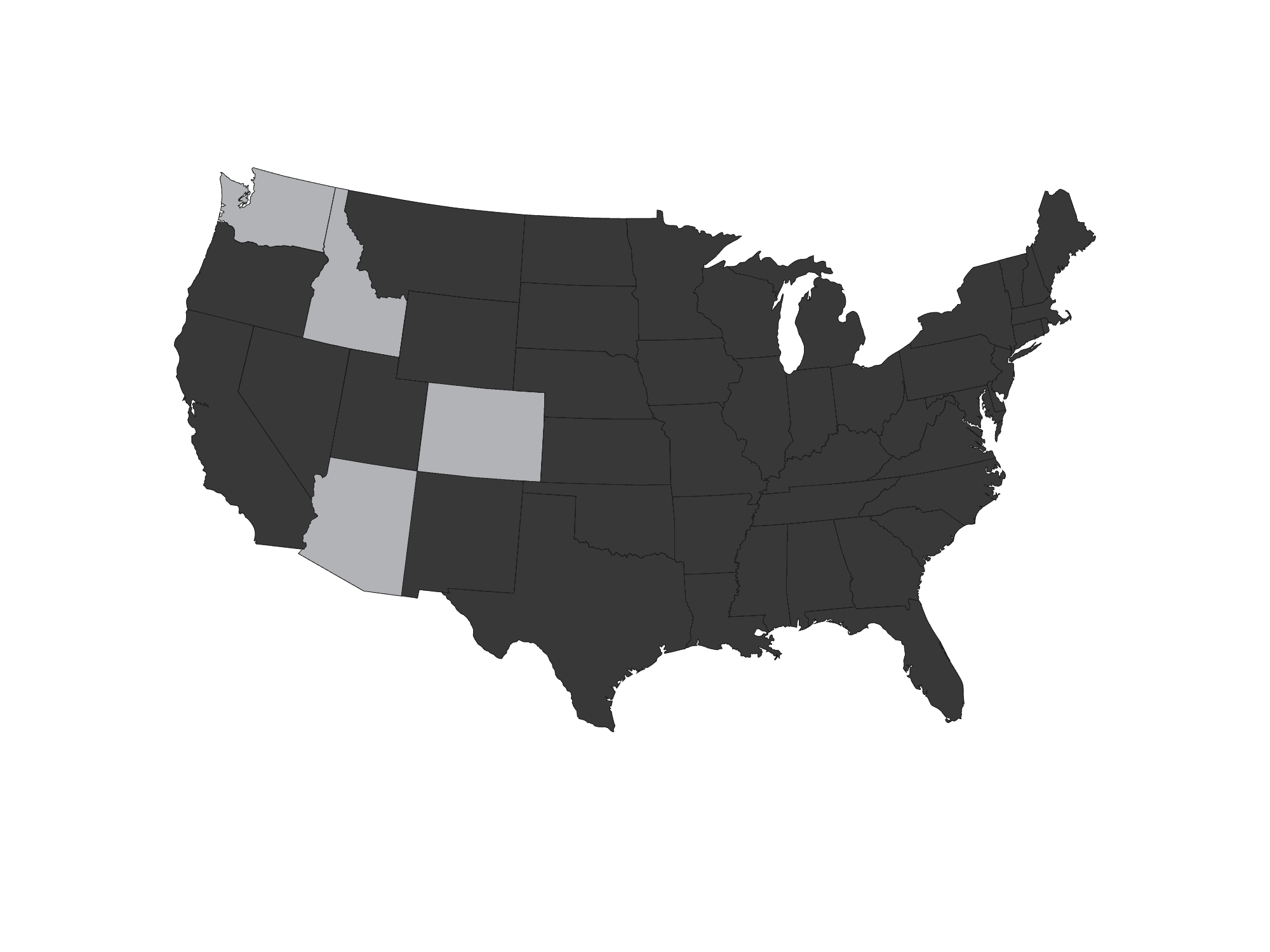

Founded in 2012, Alturas Capital Partners (ACP) is a Boise, Idaho-based real estate investment and operating company. ACP manages the Alturas Real Estate Fund, an open-ended, evergreen commercial real estate investment fund. The Fund aims to build a diversified portfolio of income-generating properties in U.S. growth markets, focusing on the Intermountain West and Inland Northwest. The portfolio includes value-add, core-plus, and development projects across office, retail, industrial, and residential properties in several Western states.

Our Values

Our team embodies and upholds our core values, ensuring that we continue to have a well-aligned, capable team that is empowered to act and keep moving the company forward.

Our Story

Blake Hansen and Travis Barney founded Alturas Capital Partners (ACP) in 2012 as the real estate investment arm of Alturas, starting with Eagle View Plaza in Meridian, ID. This acquisition shaped ACP’s investment philosophy. Between 2012 and 2015, Blake and Travis identified many opportunities but needed outside capital to grow. In May 2015, they launched the Alturas Real Estate Fund, an open-ended fund for high-net-worth investors, offering diversification and flexibility. The Fund is fully discretionary, with decisions made for the long-term benefit of partners.